|

| Car Auto Insurance: Protecting Your Vehicle and Your Peace of Mind |

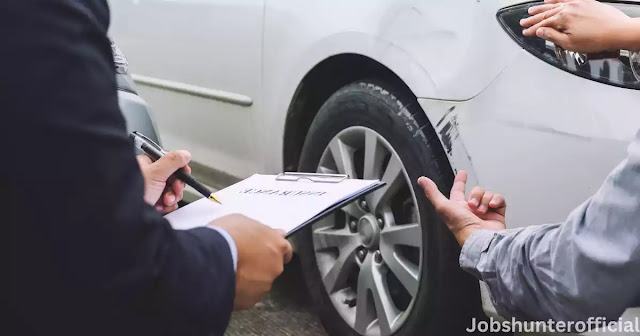

Owning a car comes with a sense of freedom and convenience, but it also carries certain risks. Whether you use your vehicle for daily commuting or occasional road trips, it’s crucial to have car auto insurance to protect yourself, your vehicle, and your financial well-being. In this article, we will explore the importance of car auto insurance and discuss key aspects to consider when selecting a policy.

What is Car Auto Insurance?

Car auto insurance is a contract between you and an insurance company that provides financial protection in case of damage to your vehicle or injuries sustained in an accident. It serves as a safety net by covering the costs associated with repairs, medical bills, legal liabilities, and other expenses resulting from a car accident.

Why is Car Auto Insurance Important?

1. Protection against financial loss: Car accidents can lead to significant financial burdens. Without insurance, you would be personally responsible for covering repair costs, medical bills, and other related expenses. Having car auto insurance ensures that you are financially protected and can avoid these potentially devastating costs.

2. Legal compliance: In most jurisdictions, having car auto insurance is a legal requirement. Driving without insurance not only puts you at risk of penalties and fines but also jeopardizes the financial security of other road users. By obtaining the necessary insurance coverage, you demonstrate your commitment to responsible driving and fulfill your legal obligations.

3. Peace of mind: Knowing that you have the appropriate insurance coverage for your vehicle provides peace of mind. In the event of an accident, you can focus on your well-being and the well-being of others involved, without the added stress of significant financial implications.

Key Aspects to Consider when Selecting Car Auto Insurance:

1. Liability coverage: This type of insurance covers the costs associated with injuries and property damage to others if you are at fault in an accident. It is typically mandatory and helps protect your assets in case you are sued for damages.

2. Collision coverage: No matter who was at fault for the collision that damages your car, this coverage will pay for the repairs. For newer or more expensive cars, collision insurance is especially crucial.

3. Comprehensive coverage: This coverage protects your vehicle against non-collision incidents such as theft, vandalism, natural disasters, or damage from falling objects. If you have a loan or lease on your vehicle, comprehensive coverage is usually required by the lender.

4. Uninsured/underinsured motorist coverage: This coverage provides protection if you are involved in an accident with a driver who has insufficient or no insurance. It helps cover your medical expenses and vehicle repairs when the at-fault driver cannot adequately compensate you.

5. Deductibles and premiums: Consider the deductible amount (the portion you pay out of pocket before insurance kicks in) and the premium (the amount you pay for the insurance policy). A higher deductible usually means lower premiums, but make sure you can comfortably afford the deductible amount if an accident occurs.

6. Additional benefits and discounts: Insurance companies often offer additional benefits such as roadside assistance, rental car coverage, or discounts for safe driving, multiple policies, or having certain safety features installed in your vehicle. Assess these options to maximize the value you receive from your insurance policy.

|

| Car Auto Insurance |

In conclusion, car auto insurance is an essential aspect of responsible car ownership. It safeguards you against financial loss, ensures legal compliance, and provides peace of mind. When selecting a policy, carefully consider the coverage types, deductibles, premiums, and additional benefits offered by insurance providers. Remember, each individual’s insurance needs may vary, so it’s important to choose a policy that aligns with your specific requirements. By investing in comprehensive car auto insurance, you can drive with confidence and protect yourself from unexpected expenses.

You have to wait 35 seconds.